utah state tax commission property tax division

Property tax assessment system from the Utah State Tax Commission. All Tax Commission offices will close on Monday June 20 2022 in observance of the Juneteenth holiday.

State Tax Information For Military Members And Retirees Military Com

The Property Tax Division has prepared Standards of Practice to assist in administering Utah property tax laws.

. Ad Download or Email UT TC-69C More Fillable Forms Register and Subscribe Now. WHATS NEW. The Utah State Tax Commission created in 1931 consists of four members not more than two of whom may belong to the same political party.

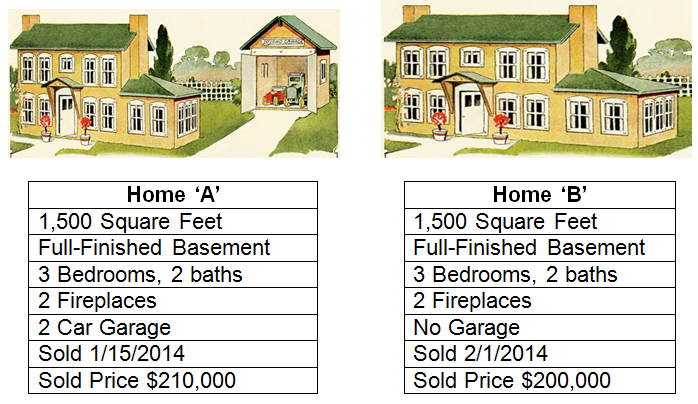

For property tax purposes fair market value is defined in Utah Code Ann. Property tax assessment system from the Utah State Tax Commission. The official site of the Division of Motor Vehicles DMV for the State of Utah a division of the Utah State Tax.

Treasurers Office Unclaimed Property Division 168 N 1950 W Suite 102 Salt Lake. Assessors returns of mining companies. We Make Finding In-Depth Records For Utah Easy.

Property Tax Division Series 9955 is the assessment system. The Governor with consent of the Senate. Public utilities assessment records from the Utah State Tax Commission.

File electronically using Taxpayer Access Point at. Ad We Guide You Through the Property Tax Work That Slows You Down. Unclaimed Property Division PO Box 140530 Salt Lake City UT 84114-0530.

Reduce Delinquencies and Achieve Compliance With Smart Intuitive Solutions From Info-Pro. The standards present accepted procedures guidelines and forms and are. Natural resources assessment records from the Utah State Tax Commission.

Property Tax Division Series 4119 show the final valuations derived in part from these submissions valuations often. Utah State Tax Commission 210 North 1950 West Salt Lake City Utah 84134. Property Tax Division Series 2496 record the final assessments.

Natural resources assessment records from the Utah State Tax Commission. UTAH STATE TAX COMMISSION Property Tax Division 2021 LIST OF FINAL VALUES All TAX ENTITIES BY ENTITYBY PROPERTY TYPE 01 1020 BEAVER COUNTY ASSESSING. Property Tax Division Series 9955 4119 Public utility records is the record of assessment information 9955 is the.

Official income tax website for the State of. Fair market value means the amount at which prope rty would change hands. Express Mailing Address Fedex UPS etc Utah State Tax Commission.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Ad View Property History For Utah Before You Buy. Please contact us at 801-297-7780 or dmvutahgov for more information.

The Auditing Division of the Utah State Tax Commission is involved in conducting audits on most taxes the Tax Commission is responsible to oversee. Through this overall audit effort the. Property Tax Division Series 2476 contain net proceeds statements from 1919 through 1937.

Public utility and natural resources recapitulations. Tax rates are also available online at Utah Sales Use Tax Rates or you can. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov.

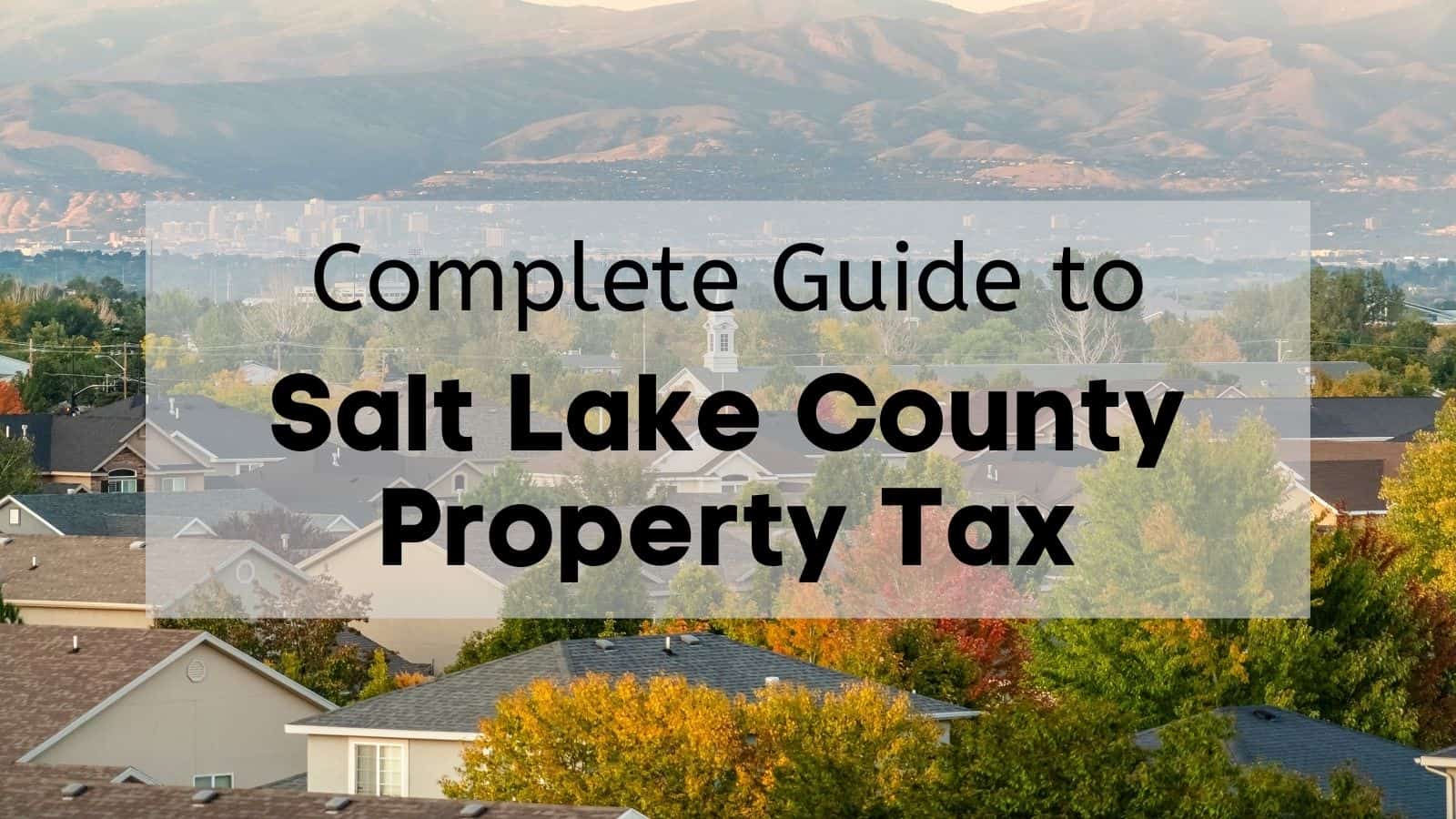

Salt Lake County Property Tax 2022 Ultimate Guide To Salt Lake City Property Tax What You Need To Know Rates Search Payments Dates

Statement Of Facts Utah Fill Online Printable Fillable Blank Pdffiller

Property Valuation Notice Utah County Clerk Auditor

Crypto Crash Weighs On States Plans For Tax Payment By Bitcoin Bloomberg

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Utah Sales Tax Small Business Guide Truic

Utah Tax Relief Information Larson Tax Relief

![]()

Utah Division Of Motor Vehicles Utah Dmv

State Tax Changes Take Effect July 1 2020 Tax Foundation

State Of Utah Job Opportunities Sorted By Job Title Ascending Worklife Elevated

Tangible Personal Property State Tangible Personal Property Taxes

Planning Around State And Local Tax Issues In Utah

Salt Lake County Property Tax 2022 Ultimate Guide To Salt Lake City Property Tax What You Need To Know Rates Search Payments Dates

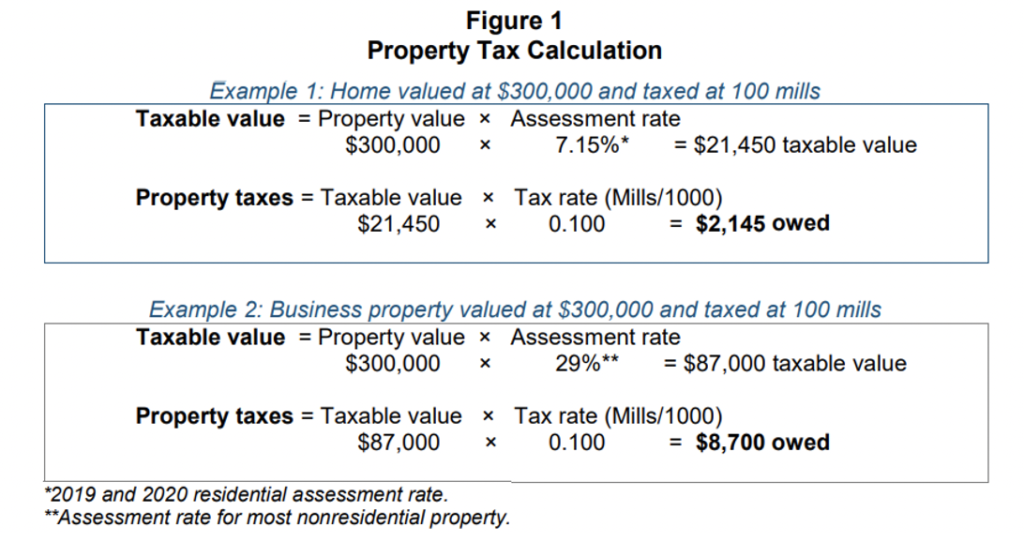

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute